December 03, 2021

Paper Manufacturing, Distribution & Transportation – update from Spicers

The following information and data has been supplied by Spicers, a key supplier of paper products

Shifting Industry Dynamics – Supply Constraints

- Supply is constrained with many paper manufacturers having closed mills, idled machines or converted over to packaging papers following the pandemic-driven collapse of demand.

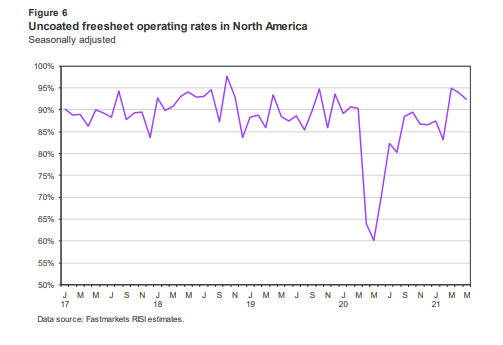

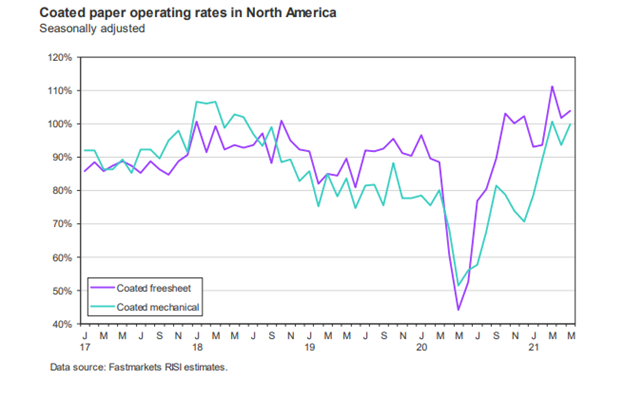

- Now, so much capacity has come out that Mill Operating Rates have ascended dramatically with post-pandemic improvements in the North American economy and higher demand for print.

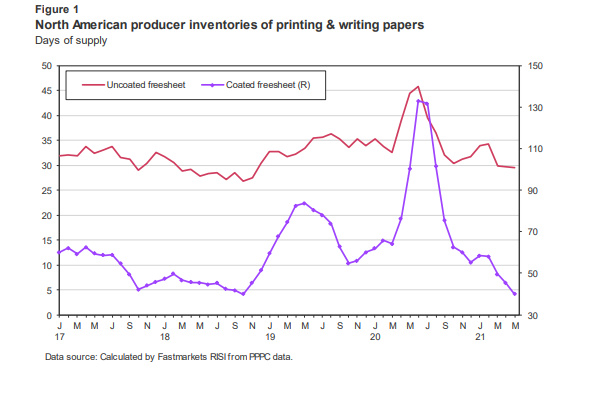

- Mill inventories on Coated and Uncoated Papers are at the lowest levels since 2018.

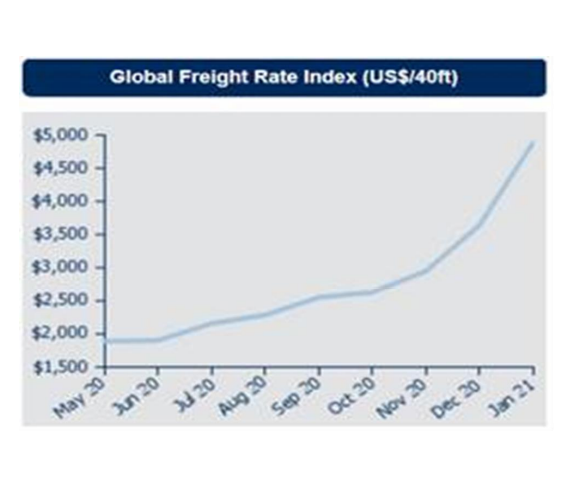

- Normally, offshore imports would be expected to quickly fill the gap between domestic supply and demand, but with the disruption to global shipping markets, international transport is difficult and expensive.

- Offshore lead times have extended by several months for most shipments.

- So much capacity has left the market since the first half of 2020 that availability is an issue for many grades.

Uncoated Operating Rates in North America

Mill Operating Rates have ascended dramatically since 2020

Coated Paper Operating Rates in North America

Operating Rates have risen rapidly since the beginning of the pandemic and are extremely high.

North American Producer Inventories

Mill Inventories are at their lowest level since the tight market of 2018

Shifting Industry Dynamics – Pricing Dynamics

- Most of the increases that were projected for later in 2021 or even 2022 are occurring more quickly as demand increases. Key drivers are:

- Raw material costs continue to climb

- Texas storms, Suez Canal blockage have impacted supply

- Industrial Chemicals have risen in the last 4 consecutive quarters (14.7% in Q1 & 11.9% in Q2 in 2021

- Pulp rose 14.4% in Q1 and 22.8% in Q2 2021

- Trucking costs continue to rise, with increases of 6.7% to 14% in each of the last 4 quarters

- Global container availability has caused a dramatic rise in costs and shipping delays

- increases range from 400% to 600%

Ratio of Loads to Trucks – Domestic Trucking is Challenged

Trucking demand is high with approximately 5 truckloads of product to ship for every 1 available truck. While typically we would see a softening of rates prior to produce season, that hasn’t occurred, and as we enter both produce and hurricane seasons, it’s suggested high transportation costs will continue throughout 2021.

Global Ocean Freight Trends

- Globally ocean freight rates are continuing to climb fueled by demand and equipment shortages in Asia

- Capacity and equipment continuing to be scarce

- Introduction of “Premium Surcharges” that shippers pay in order to get guarantee space, equipment etc.

- Container costs have increased by 400 to 600% causing dramatic escalation in product pricing

- Lead times are months longer than normal

Canada Inflation Summary – Highest level since 2011

Conclusions

- Supply will continue to be constrained as the economy improves post-pandemic

- Mill manufacturing capacity is lower, mill inventories are lower and operating rates are high, so making more paper isn’t an option

- As well, trucking and ocean freight are more expensive and less available, and demand is strengthening

- We expect that pricing pressures will continue to build over 2021 and into 2022

- Price increases are expected to continue as the market constraints continue

- This will impact paper, plastics, polyethylene, polypropylene and many other goods

- We strongly encourage planning ahead and forecasting your needs

- Our commitment is to communicate with you and to build upon programs together to mitigate challenges as much as possible